Gold and silver are pulling back right now, but this comes on the heels of an incredible rally.

Blog

Silver has been hated and ignored for decades.

Many failed to see the potential in gold's little sibling.

But the silver market is finally attracting significant attention — not just from retail and institutional investors, but also from mainstream outlets.

The silver market is up nearly 86% so far this year.

And according to the Silver Institute, the silver supply deficit is forecast to reach around 187.6 million ounces.

Should this trend persist, it would mean five consecutive years of annual deficits, amplifying supply-side pressures.

Meanwhile, geopolitical tensions, particularly between the U.S. and China, continue to drive global market volatility, driving demand for physical precious metals.

The current U.S. government shutdown is further contributing to uncertainty in financial markets.

Although silver has recently paused just below $53 per ounce, market fundamentals suggest this is a just temporary consolidation.

The best is yet to come for precious metals.

This week only: Take advantage of our exclusive pricing on 10 oz. Silver Bars at $0.99 over spot.

Claim your share now—call ASI at 1-800-831-0007 or email us today.

Now that gold is trending mainstream, it is important to understand why bullion bars and coins are by far the best way to own gold.

Silver just shattered the $50 per ounce barrier.

It blew past all previous highs, sending a clear message...

the precious metals market is on fire.

Up 68% year-to-date, 2025 stands as the most explosive silver rally since 1979.

But this momentum isn’t cooling off—it’s picking up speed, already above $52.

September alone was electric, driving prices up another 15%. The fuse is lit by unstoppable forces:

- Soaring demand from cutting-edge industries

- A relentless five-year global supply deficit

- Fierce profit motive

Silver’s smaller market punches hard—every dollar move hits with outsized impact.

With gold cracking $4,000 and pricing many out, silver is becoming the lightning rod for serious investors hunting real opportunity.

Its lower entry point compared to gold is pulling in a surge of new investors, each racing to ride the historic 2025 bull run before the next leg up.

History shows silver outmuscles gold in raging bull markets—think 2020: gold up 26%, silver up 48%!

In the epic 2001–2011 surge, silver exploded 1,000% off its lows while gold made headlines at 650%.

Bottom line: silver’s run is nowhere near finished.

If you’re waiting, you’re risking missing one of the biggest plays of this decade.

Claim your share now—call ASI at 1-800-831-0007 or email us today.

This week only: Take advantage of our exclusive pricing on 1 oz. Silver Buffalo Rounds at $1.59 over spot.

Silver has been obtainable at rather low premiums for months now, but rising spot prices are starting to draw attention, and premiums are on the rise!

Your portfolio is facing challenges from depreciating asset values.

This government shutdown could be different – and not in a good way.

The potential economic impacts may be downright dangerous.

Historically, government shutdowns have created political turmoil in Washington, D.C., but their economic effects have typically been limited and quickly reversed. Even the protracted 35-day shutdown of 2018-2019 resulted in few lasting consequences for U.S. financial markets.

However, the current landscape in 2025 is markedly more precarious.

- The labor market is faltering

- Proposed federal workforce reductions are compounding uncertainty.

- The stakes are considerably higher

This shutdown is introducing additional disorder, disrupting an already fragile environment.

Moreover, it will likely postpone the release of critical economic data—including upcoming employment reports and key inflation indicators. This may leave business leaders, investors, and Federal Reserve policymakers without essential insights as they navigate crucial decisions.

The solution, of course, is sound money.

Gold and silver.

While you can't control how this government shutdown will impact the economy, you can prepare your portfolio to fight against the impact to your wealth.

While gold is breaking records with all-time highs, silver is just hitting its stride.

Less than $2 from its all-time high, the profit potential is vast.

Silver offers similar benefits to gold as a hedge against economic volatility, yet the lower entry point makes it much easier to take advantage of the stampeding bull market rally.

In September, silver surged 15%—marking its strongest monthly advance in more than two years—building on an 11% gain in August and a further 1.5% increase in July.

That puts silver up roughly 50% for the year... and still climbing.

So, what's the most cost-effective way to buy silver right now?

Junk Silver.

That is, 90% silver pre-1965 dimes, quarters, half dollars, etc.

The unique benefits of Junk Silver:

- Finite supply

- Highly divisible

- Insanely low premiums

The best part... junk silver is currently available BELOW SPOT PRICE.

To secure your silver now, give the ASI team a call at 1-800-831-0007 or email us today.

Seize this moment—silver is making global headlines, and top financial institutions are taking decisive action.

The Saudi Arabian sovereign wealth fund’s recent $40 million allocation to silver funds is just the latest endorsement fueling rampant speculation that silver is set for a monumental comeback as a monetary metal.

Now is the time to act.

Silver is up 55% YTD—a clear, powerful signal of a bull market breakout.

Industrial consumption has dominated silver demand over the past few years, but the current climate reflects a marked increase in investment-driven interest.

Sentiment is starting to shift.

Opportunities for substantial returns are opening up fast.

As gold leads and silver follows with renewed strength, sophisticated investors are identifying compelling profit opportunities at these levels.

Both gold and silver serve as anchors of financial security—hard assets that provide critical diversification and help mitigate portfolio volatility.

Gold spot prices have already exploded in 2025, while silver at $46 per ounce offers an extraordinary entry point for investors eager to protect and grow their portfolios with hard assets known for stability in volatile markets.

This is your chance to get ahead of the curve.

Analysts agree: silver could easily challenge $50 an ounce before year’s end, and may even target $90–$100 per ounce in the next few years.

The momentum is unmistakable—and so is the profit potential.

Don't underestimate what silver can do for you.

To secure your silver bars and coins now, give the ASI team a call at 1-800-831-0007 or email us today.

P.S. We're offering a special offer this week only on backdated 1 oz. Silver American Eagles. Premiums on these coins are starting to rise once more. Current inventory allows us to offer 1 oz. Silver American Eagles at a premium of just $3.29 over spot—an opportunity that may not last as supply tightens and interest accelerates.

This a critical moment for investors.

Gold has surged to record highs, approaching $3,800 per ounce—an increase of over 40% year-to-date. Silver is trading above $44 an ounce, drawing nearer to the all-time high of $50.

In this dynamic market, it may be an opportune time to evaluate your precious metals holdings.

We can help.

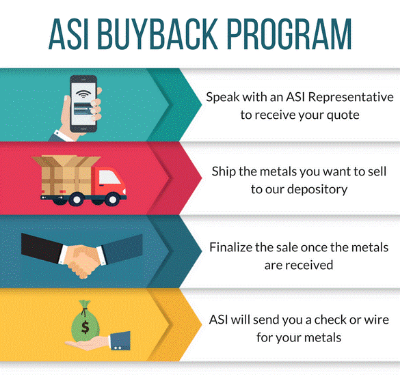

Selling your precious metals through ASI is a secure, efficient process engineered to meet your objectives with clarity and confidence.

How Do I Sell My Metals?

The first step is communication—sharing your objectives and concerns allows us to tailor the experience to your goals.

When you’re ready to proceed, simply contact us. Here’s what you can expect:

- The Covid-19 Pandemic.

- The 2008 Recession.

- The Dot-Com Bubble Burst.

What do all these things have in common?

Gold performed tremendously during these volatile moments in history.

But none of them come close to gold’s performance in 2025.

As a matter of fact…

Gold hasn’t seen a rally like this since 1979.

The extreme inflation of the 1970’s lead to huge gains in gold as the money supply expanded, especially once gold and the U.S. dollar were no longer coupled.

In 2025, gold is around $3,700 an oz., nearly double where it was in 2020.

It’s up 40% this year alone.

Yet, there is still a clear signal to buy.

Gold’s rally is not yet over.

And you may be kicking yourself in several years if you didn’t buy gold when it was “dirt cheap” at nearly $4,000.

There’s a great opportunity to buy today. Gold took a slight retreat early Friday from Wednesday’s record high as the dollar strengthened.

The worsening labor market prompted the Fed to cut 25 basis points last week, even though inflation is getting worse.

Inflationary pressures show no sign of abating.

If inflation will continue to worsen, then what are you waiting for?

There is an antidote for inflation.

Gold.

Gold remains the proven safeguard against accelerating inflation.

Even a modest position can transform your portfolio’s resilience.

Yet, premiums are still low and demand is lagging gold’s historic performance.

Take the antidote: lock in 1 oz. Gold Krugerrand at $89 over spot. Plus, we’re adding a FREE 1 oz. Silver Eagle for every 3 gold coins you buy from us.

Give us a call at 1-800-831-0007 or email us to place your order today.