Has gold has reached a peak or does it have enough fuel to push higher?

Blog posts of '2025' 'July'

The average annual silver price rose 25% through the first six months of 2025, closely following the average gold price, which increased by 26% during the same period.

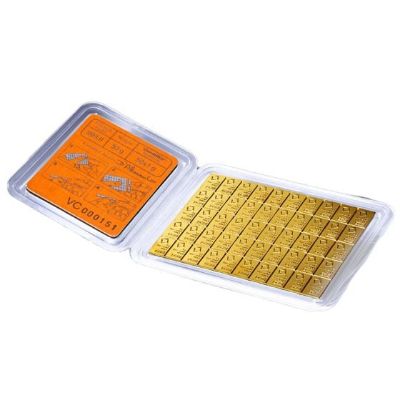

Gold is up 26% so far in 2025, down slightly after reaching a new all-time high just above $3,500 in April. It rose 27% in 2024, its biggest annual gain since 2010, driven mainly by central bank gold buying. But this bull market is just getting into full swing. And individual investors are starting to wake up...

If you've been waiting for silver to show signs of life, the signs could not be more clear than right now.

Gold spot prices have fallen to just above $3,300, down early this week after dipping slightly (just 0.1 and 0.2%) in May and June. The Independence Day holiday meant that U.S. financial markets were closed Friday, and a delay in trade negotiations has also lessened haven demand for gold. The Trump administration announced the possibility of tariff reprieves for several countries, leading to a longer negotiation period over tariffs.

_400.png)